The Stablecoin Pact: Crypto's New Order after the GENIUS Act

A historic Senate vote will push crypto from its money era into its finance era

On Monday, the Senate voted 66-32 to invoke cloture on the GENIUS Act, a bill that regulates the creation and offering of stablecoins in the US. While the bill still needs to clear the House and be signed by President Trump, passing the Senate was the biggest challenge (given that it required Democratic support to hit the 60-vote threshold for cloture). With that hurdle cleared, the GENIUS Act is now on track to become the first piece of crypto legislation passed by Congress.

It's ironic that the first-ever crypto legislation enshrines fiat currencies into the fabric of blockchains. This is a far cry from the early crypto days where fiat was the enemy, and the separation of money and state was the goal. Fast forward, and now US politicians are talking about how blockchains could further the dominance of the USD.

How did we get here? And where are we headed next? With stablecoins now set to be enshrined in law, crypto's journey from aspiring anarchist money is pointing squarely at its true destination: stateless financial infrastructure.

Blockchain, not Bitcoin

In the early days of Bitcoin and crypto, there was a common sentiment among the suits of Wall Street: they were interested in the underlying technology of Bitcoin (blockchains) more than in Bitcoin the currency. Some even started what they called “enterprise blockchains”, while others dropped the blockchain moniker altogether and said they were building “distributed ledger technology”.

None of those efforts succeeded at attracting usage and were generally scoffed at by those in the Crypto industry (and not just Bitcoiners), because they weren’t permissionless or decentralized. The suits of Wall Street believed that a volatile currency was not going to become the foundation of a new financial system, and eventually us crypto bros figured it out. As we highlighted in (my favorite) Dose of DeFi in February 2020:

There’s a common trope where a Bitcoiner – typically an American male – admonishes an inflation-ravaged country and preaches the gospel of Bitcoin and its fixed supply. From his comfortable perch on Twitter, he speaks of how Bitcoin is the solution to a developing country’s woes, if only the people would appreciate hard money and Austrian economics.

So far, Bitcoin has not been a savior to any economy. Its censorship resistant P2P payments have given individuals in repressed regimes an important lifeline, but it has not been adopted at scale in Venezuela, Zimbabwe or other inflation-challenged countries.

We thought they wanted Bitcoin, but maybe it was just the US dollar?

In the end, ideological skirmishes gave way to market demand. The quiet utility of dollar-backed tokens on blockchains proved to be the pragmatic path for adoption.

Crypto grows up

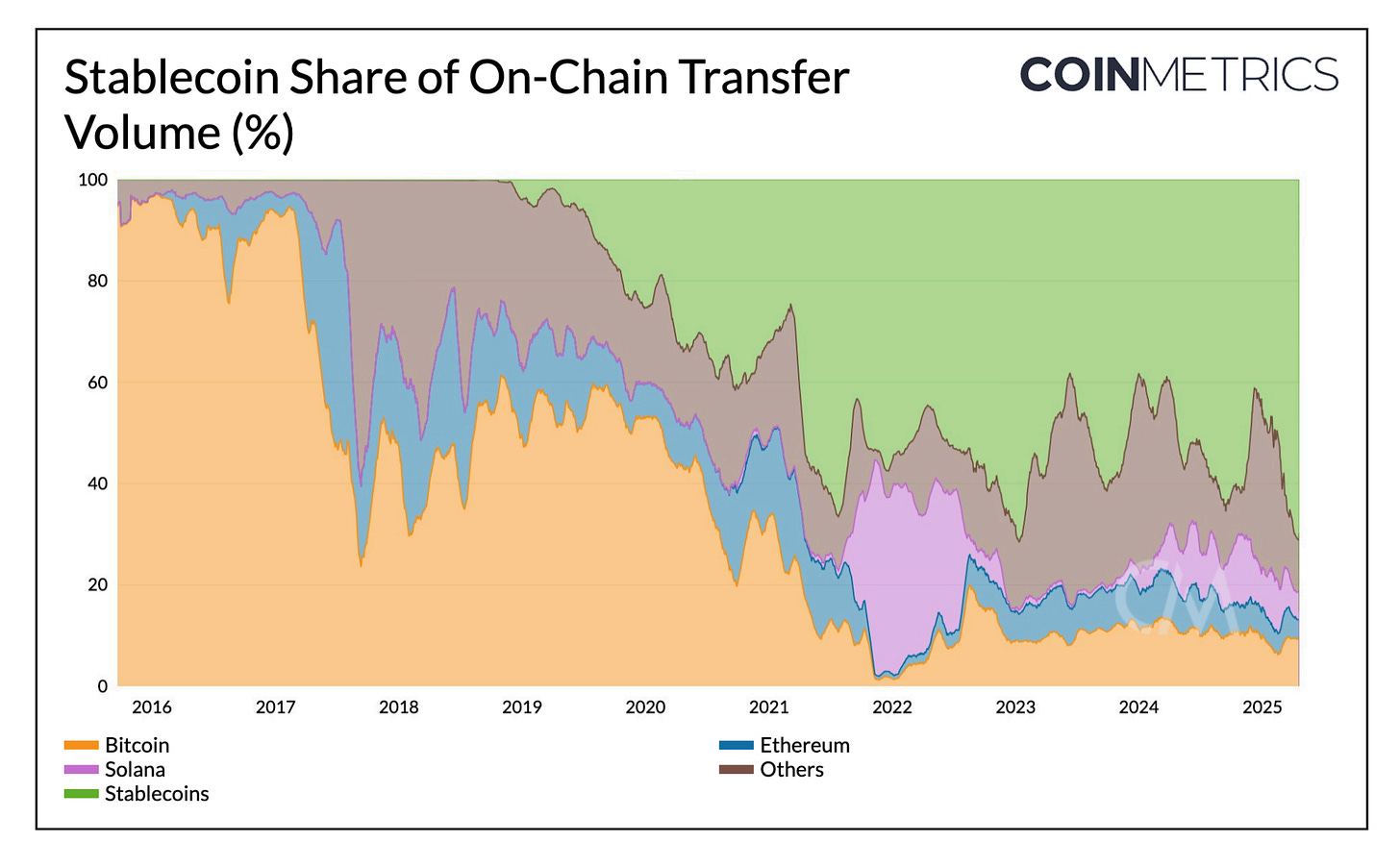

So, it seems crypto's adolescent dreams of overthrowing the monetary order have largely faded (for now), replaced by the more sober reality of its fundamental role as financial infrastructure. Early Bitcoiners were hyper focused on making the money angle work, but in the end, there were no takers (sin El Salvador). People, as it turns out, were less interested in a new currency and more interested in using these novel blockchain rails to move good old US dollars around the globe, efficiently and quickly.

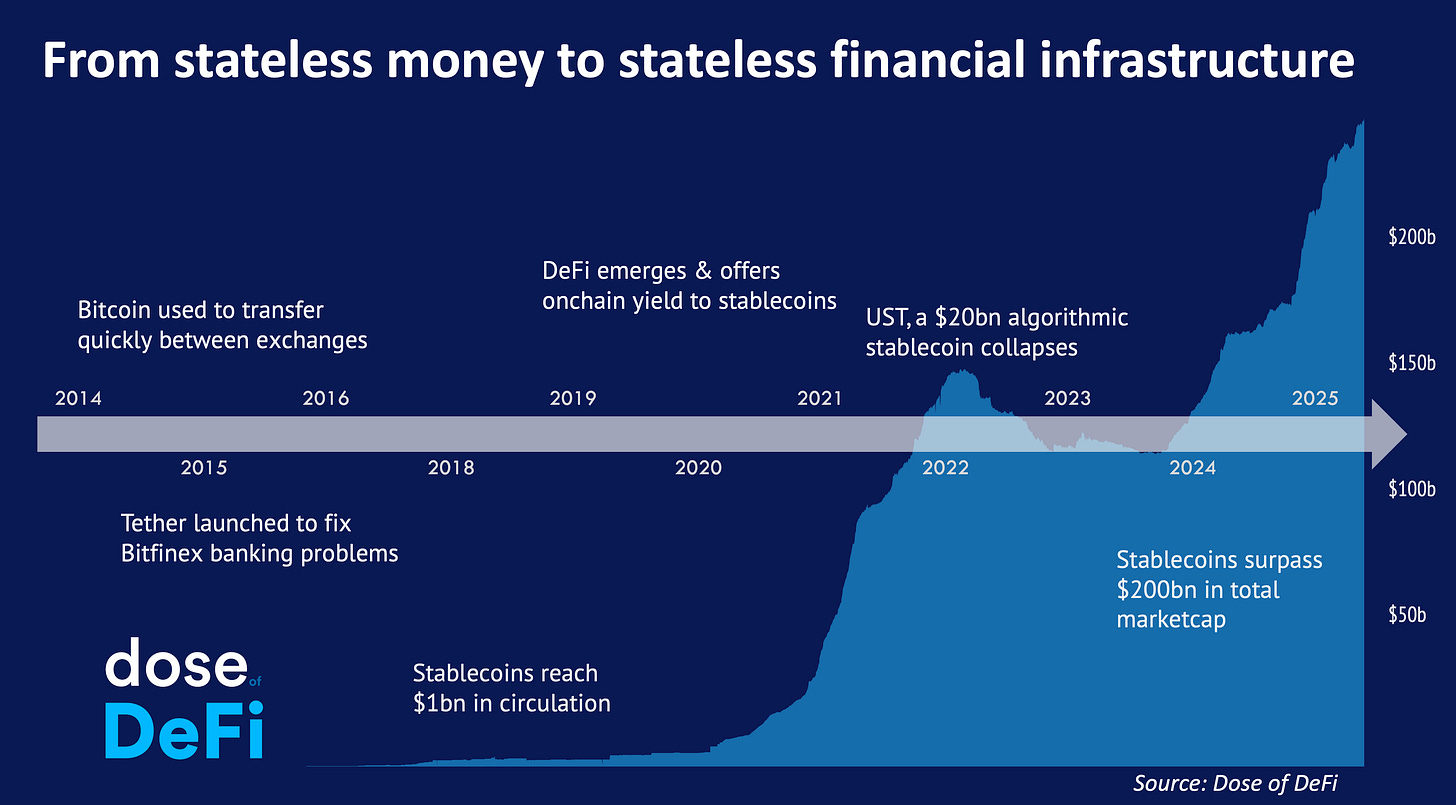

This proved particularly helpful in the often-clunky world of crypto exchanges as Bitcoin professionalized after the 2013 bubble. Initially, Bitcoin itself served this purpose: you could withdraw it from one exchange and deposit it into another, sidestepping the ponderous bank wire system as long as both platforms supported BTC. Then came Tether (USDT), offering an upgrade by removing the pesky currency risk inherent in using Bitcoin as a bridge asset. Why gamble on Bitcoin's price swings when you just wanted to move value?

A few years later, after the 2017 ICO bubble created assets onchain and thousands of ERC-20 tokens, new DeFi trading and lending protocols launched, adding another layer of validation for blockchains (as genuinely-useful financial plumbing). It soon became apparent that crypto’s most popular product – leveraging-up to buy more crypto – only works if you can borrow in a stable currency. These new DeFi lending platforms provided the first onchain yield for stablecoins, and in doing so, broadened their appeal beyond traders to anyone simply looking to save in dollars, especially if they were outside the traditional US financial system.

The stablecoin ah-ha moment

It’s important at this point to remember that this wasn't some grand, orchestrated plan by the US government. No one told Bitfinex to use a USD stablecoin to solve their banking problems. Justin Sun wasn't acting on a State Department memo when he used dollar stablecoins for his gambling apps in emerging markets. And no one from the Treasury told Uniswap to upgrade its v2, which newly enabled any asset to be paired with stablecoins, not just ETH. This was raw, unadulterated market demand. Blockchains proved to be remarkably efficient financial rails, made infinitely more useful by allowing the world's reserve currency, dollars, to flow through them.

This organic, market-driven gravitation towards US dollar stablecoins is precisely what jolted lawmakers into action. There's always been chatter about crypto regulation, oscillating between suffocating overreach and a dangerously light touch. But the stablecoin bill managed to cross the finish line because the usual crypto advocates found unlikely allies, like Senator Mark Warner (D-VA):

The stablecoin market has reached nearly $250 billion and the U.S. can’t afford to keep standing on the sidelines. We need clear rules of the road to protect consumers, defend national security, and support responsible innovation. The GENIUS Act is a meaningful step forward.

So, to recap: crypto’s big experiment as a new form of money mostly belly-flopped. But as financial infrastructure? It has found its footing, ironically by hitching its wagon to the very US dollar it once sought to supplant. The explosive growth of stablecoins forced the legislative hand, but this bill isn't designed to kill stablecoins. It's the opposite. It’s a legitimization, a welcoming committee ushering stablecoins from the shadowy corners of Degenistan into the brightly lit, compliance-polished plazas of Wall Street and the meticulously-curated walled gardens of Silicon Valley.

Stablecoins in the US: New financial plumbing

Now back to the GENIUS Act, which isn't just about regulating some niche crypto asset. It's laying the groundwork for a rewiring of US financial plumbing, with stablecoins at the center. While there are short-term competitive dynamics for existing stablecoins, the long-term implications are broad, touching everything from how we pay for things, to the very structure of banking.

Payments and the Stripe test: The most immediate impact will be on payments, and we're already seeing major players dip their toes in. Stripe, the leader in online payment processing, has rolled out stablecoin-powered financial accounts – initially supporting USDC – targeting businesses globally. It also acquired Bridge, a stablecoin infrastructure company, which enables some smooth DeFi onboarding experiences. Visa and Mastercard are also in the game, enabling consumers to spend stablecoin balances through their existing card networks, by partnering with issuers and wallet providers.

Bank disintermediation and the rise of ‘narrow banking’: This is where things get really interesting (and potentially uncomfortable for traditional banks). If stablecoins become a preferred way to hold and move dollars, especially for businesses and digitally-savvy consumers, what happens to bank deposits? The traditional banking model relies on deposits to fund lending. If a significant chunk of those deposits moves into stablecoins, held in digital wallets or on platforms like Coinbase, banks could find themselves disintermediated.

The truth is, banks are kind of already disintermediated when it comes to lending. Yes, yes, they do a lot of small business and mortgage lending, but specialized mortgage lenders often originate these loans, which are then funded by larger banks from their balance sheet. In a new world, these mortgage lenders would partner with investment funds that are specialized in evaluating mortgages (or any loan). And so, we unbundle into a loan originator and then an investor. If you squint, this looks like what the large debt markets are now, both public bonds that are freely traded and private credit, which is so hot right now. This shift toward what economists call "narrow banking" – where financial institutions take deposits but invest them primarily in safe assets like treasuries rather than making loans – is being accelerated by stablecoins.

Yet this future may be a ways off, because the banking lobby was able to insert a provision in the GENIUS Act that prohibits interest-bearing stablecoins. While the aim is likely to mitigate risk, the demand for yield is a powerful force. We can anticipate that interest will still ‘leak out’, potentially to less regulated, non-US based platforms and products, similar to how Aave rates can spike due to strategies like looping Ethena’s USDe, or the emergence of offerings like Sky Savings Rate. If these external platforms become significant, this could eventually create new systemic risks for the US financial system, forcing regulators to play catch-up with stablecoins once again.

Huge new opportunities in DeFi (and the question of your next mortgage): So, if banks aren't the primary source of credit, where will you get your mortgage? Or your small business loan? Enter DeFi. Our hope is that DeFi can step in to make this evolving credit system more transparent and efficient. We don't have to use banks to extend credit; we do so now within a heavily regulated market structure designed to ensure stability. DeFi protocols already offer avenues for yield through lending and liquidity provision. Imagine a future where your mortgage isn't funded by a bank but by a DeFi protocol, funded by a global pool of stablecoin liquidity. Yield-bearing stablecoins like BlackRock's BUIDL fund or Ondo Finance's OUSG offer a glimpse. These products provide compliant access to yields from traditional assets like US Treasuries, often for institutional and accredited investors. Could similar structures be adapted for broader consumer lending? This could create a vibrant, though potentially riskier, landscape for credit. A new order with less credit intermediated through banks might be better, but we need to tread very carefully.

Stablecoins outside the US: The dollar’s new dominance

While of course the immediate implications of the bill lie within US borders, it also plants a seed for a shift in the role of the USD world-over. The other irony of the rise of stablecoins is that Tether, (by far) the largest US dollar stablecoin, is domiciled outside the US. While Tether complies with all US law enforcement requests regarding KYC/AML laws, its founders have been skittish about entering the US.

And while American politicians are focused on what happens to American citizens, the GENIUS Act will have an even greater effect on the rest of the world. Whereas for the US, stablecoins’ legitimization will lead to a change in market structure for credit dissemination (that’s a big move!), for the rest of the world, it will challenge the monopoly of local currencies. This isn’t just about finance; it’s about monetary sovereignty.

Fiat currencies: The new local newspapers?

The dynamics here about local monopolies collapsing remind us of Ben Thompson’s Aggregation Theory for media. It’s playing out again, but this time with money. When distribution costs for news collapsed thanks to the internet, most city papers withered and died, while giants like The New York Times went global. The internet rewarded the biggest, most trusted brand.

The same dynamic is about to hit fiat currencies. Citizens, especially in countries with unstable economies or restrictive financial systems, will increasingly prefer USD-denominated stablecoins because they're perceived as more stable and offer access to global commerce. Governments, naturally, will be inclined to restrict them to protect their own monetary control, but can they really? Network effects are powerful.

The Trump factor

This runaway success story for US dollar stablecoins hinges on a critical assumption: that the US wants to remain the global reserve currency, and that increased dollarization is actually good for the American people. The Trump administration, interestingly, seems to think otherwise, actively trying to de-dollarize the world with the so-called Mar-a-Lago Accords. It’s not entirely clear what their endgame is, or how Americans truly feel about this.

But just look at the recent jump in US Treasury yields as the Trump administration's rhetoric spooked foreign investors from holding treasuries. Lower global demand for dollars and treasuries doesn't just mean more fiscal headaches for the US government; it translates to higher mortgages and car loans for everyday Americans. So, while the crypto world is busy building on-ramps for global USD stablecoin adoption, the question remains: is this truly the desired outcome for the US itself? The GENIUS Act might officially be about regulating stablecoins, but it's inadvertently supercharging a much larger domestic conversation about the dollar's future role.

Stateless money vs. stateless financial infrastructure

While crypto is moving onto stablecoins and stateless financial infrastructure, it will never fully abandon its dream of monetary sovereignty.

Bitcoin has definitely achieved stateless money. It marked another all-time high this week and still has a long way to run as digital gold (even if it’s not toppling dictatorships). Other forms of stateless money will likely emerge. Some would argue – and we’d agree – that Ethereum has reached that level precisely because it is such a core stateless financial infrastructure for so many stablecoins and RWAs. Solana may get there as well, but all crypto assets that achieve stateless money status will do so both through fee generation – or REV as the cool kids call it – and a monetary premium that is the collective belief in the future of the network by tokenholders - hey, not so different from Jay Powell's regular pep talks for the dollar.

But what’s crystal clear after the passing of the GENIUS Act is that stateless money will also have to compete with state money that runs on blockchains, which will use their existing network effects to bid for supremacy in an age of stateless financial infrastructure.

Odds & Ends

Gnosis launches v2 of Circles, a new community currency Link

Combined metrics for tracking smart contract networks Link

Lido proposes dual governance structure upgrade Link

Trump memecoin holders prep for private dinner reward: ‘I’ll wear a suit’ Link

Fluid struggles with impermanent loss after big ETH move up Link

New draft market structure bill released by House Republicans Link

DeFi Llama is now tracking risk curators by TVL Link

Thoughts & Prognostications

The key neutrality of baselayer markets [Alex Grieve & Rodrigo Seira/Paradigm]

A brief history of token launches [Mary/First Contact]

The price of trust [Paul Frambot/Morpho]

Crypto and the Evolution of the Capital Markets [Tuongvy Le & Austin Campbell]

Dawn of LP profitability [Bunny Diaries]

Why we need new blockchains [OneTrueKirk/Morpho]

From Vanugard to Believe App, investing collapses into short form content [Lex Sokolin/Fintech Blueprint]

The case for and against multiple current proposers [Rain & coffee]

That’s it! Feedback appreciated. Just hit reply. Had a great time writing this. Feeling optimistic about DeFi!

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO/Sky. Some of my compensation comes from MKR, so I’m financially incentivized for its success. All content is for informational purposes and is not intended as investment advice.

Terrible idea

https://youtu.be/r_AtgPWRpd0?si=_TVM69DLncygi-EX