Compound's Meteoric Rise, The Oracle Wars start

Systemic Importance

Ask anyone inside or outside the space about the most important and promising project in DeFi and you’ll undoubtedly get one answer: MakerDAO. The central role of its stablecoin, Dai, certainly makes it the most structurally important, but most promising? The money market protocol Compound is making a strong case.

A slow and steady rise since its launch last October turned into hockey stick growth over the last three months, largely thanks to MakerDAO’s rising stability fee to borrow Dai. It currently has $104m of assets locked up on its protocol, tripling over the last three months, according to DeFi Pulse. By comparison, Maker has $259m in total value locked.

While other lending liquidity pools have also experienced similar growth, most notably dYdX, Compound is clearly the market leader, and like MakerDAO, other projects are now building projects and services on top of it.

In MakerDAO’s defense, it’s not trying to be a lending protocol. The lending is only a byproduct of minting a stablecoin, but as a result, it is only servicing one side (borrowers) Compound, meanwhile, has attracted borrowers with lower interest rates because it also services lenders. An interest-bearing stablecoin account is an enticing proposition.

Perhaps Compound’s biggest advantage is that it is a multi-asset protocol. There are seven assets available for borrowing and lending with Ethereum the largest asset locked as collateral. And while Dai is the most popular asset to borrow, USDC has narrowed the gap.

Next week Compound is voting on what additional assets to include. For stablecoins, this may be akin to getting listed on Binance.

Compound’s ambitions are growing with its success. In May, it launched its V2 and cTokens, which are liquid representations of the interest being earned on assets deposited on the Compound protocol. These can be held securely on a wallet or traded for another cryptoasset. Over the last 24 hours, there was $40k in trade volume for cDai on Uniswap.

And just this week, it's attempting to crack the thorniest problem of them all: oracles. The Open Oracle System, as Compound dubs it, intends to provide verifiable data onchain. There are several other interesting oracle projects out now that focus more on aligning the economic incentives, but Compound’s reach makes it a strong competitor.

MakerDAO created the most basic building block for a financial system: a currency. Money markets are nearly as important and one where size equals success. Compound’s head start puts it in a foundational position to capture the growth of DeFi.

Tweet of the Week: The Oracle Wars Begin

Joey Krug subtweeting Compound's new oracle system announcement. Oracles' importance will only grow and we have yet to see them battle in the real world, but until then, there's always Twitter.

Number of the Week: Earned Interest

The estimated amount of interest earned on decentralized lending protocols, according to a report by Graychain. That was 30.7% of all interest earned by crypto lending, with the rest occupied by central lending companies like Genesis and BlockFi. Interestingly, DeFi protocols were just 11.5% of total loans originated.

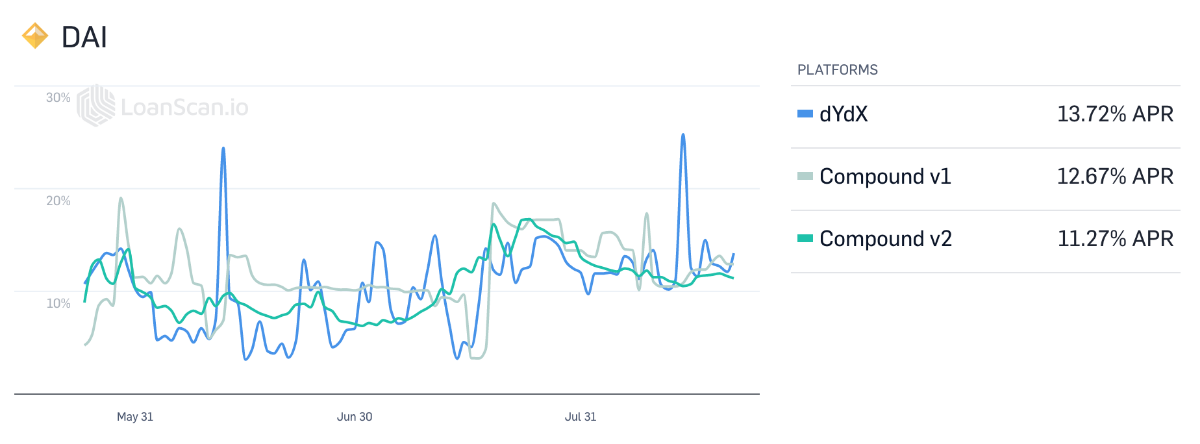

Chart of the Week: Unstable Rates

Loan Scan has made historical data on DeFi lending rates available. dYdX's gyrations are likely due to its smaller size and how a single large loan (or deposit) affects the interest rate.

Long Read of the Week: The Great Meme War

Decrypt's Ben Munster with his usual wit on the kerfuffle over Bitcoin Maximilists' hostile trolling. Twitter has been a cesspool the last week but this was a fun perspective on the mayhem.

Odds and Ends

Keep and Summa announce tBTC, a trustless bridge from Bitcoin to Ethereum Link

Set Protocol introduces Profit Pools, a smart contract that pools together profit-seeking capital Link

DeFi Pulse unveils Earn Income, tracking best lending rates across protocols Link

New company, Topo Finance promises non-custodial lending platform that optimizes interest rates across protocols Link

Guesser launches DeFi Total Value Locked options using Augur Link

r/ethtrader splinters in two, r/ethfinance is launched by departing moderators Link

New oracle service, Dirt Oracle, is live on Ropstein network Link

Centrifuge’s Tinlake aims to enable loans against tokenized real world assets Link

Thoughts and Prognostications

Crypto Bobby talks DeFi Link

Twitter thread documenting the growth of DeFi lending Link

The Economics of Ethereum Staking Pools Link

Central Banks, stablecoins and the looming war of currencies Link

Great video and twitter thread on DeFi in China [GCR] Link

Building with Money Legos [Totle] Link

Managing wealth on Compound is cheaper than Wealthfront [Max Bronstein] Link

The Real Benefits of Blockchain Are Here. They’re Being Ignored [Dapper] Link

Why I am not a Technocrat [Glen Weyl/RadicalxChange] Link

Listen of the Week: TwoBitIdiot

Messari founder Ryan Selkis on the Into the Ether Podcast discussing narratives and trends in crypto. Selkis speaks highly of DeFi and argues that Maker may be just the third blockchain project to actually find product-market-fit.